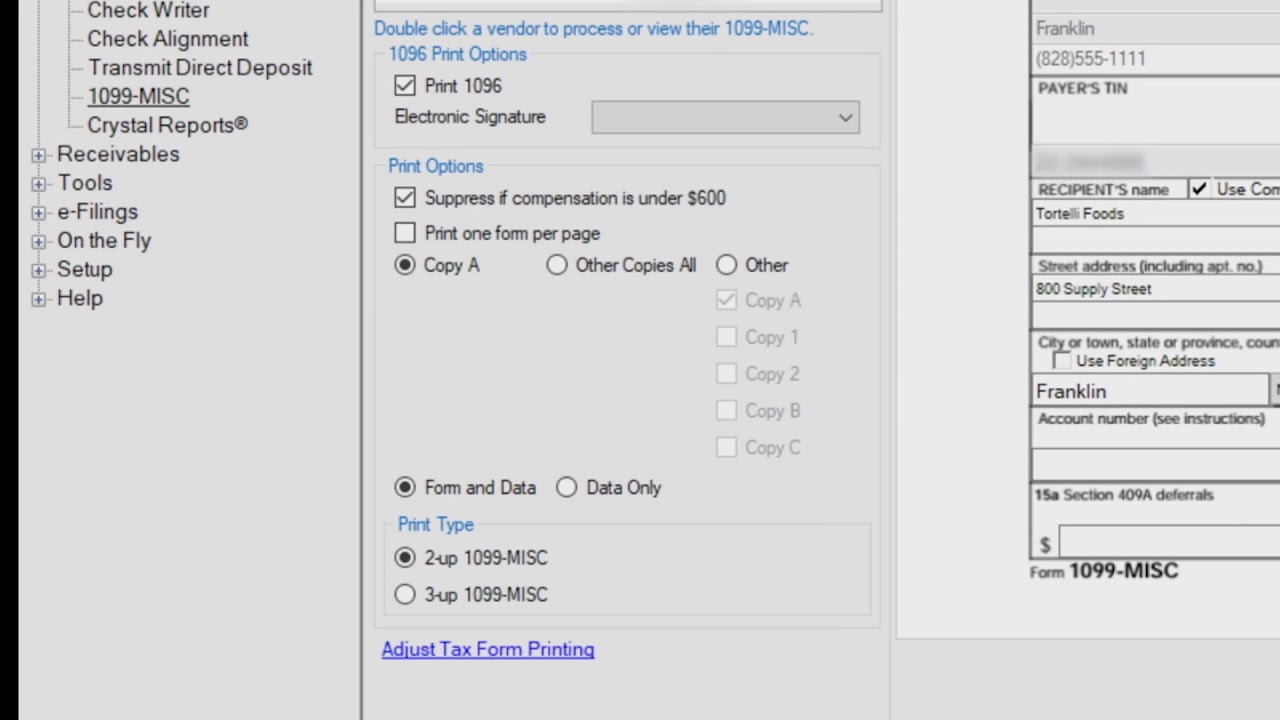

The 1099MISC has Copy A, B, C, 1 and 2 Copy A is sent to the IRS along with the 1096 Copy B is sent to the recipient and the recipient keeps that copy The payer or the business issues the 1099MISC forms to vendors/contractors should retain Copy CCopy 2 Independent contractor;FYI This is a common problem Twentyseven million taxpayers don't report all their W2 and 1099 income every year You can get this transcript in four ways 1 Mail Form 4506T, Request for Transcript of Tax Return, to the IRS This form allows you to request the wage and income transcript and a transcript of your tax return or tax account

E Filing 1099s Youtube